But AUSVEG says “there appears to be a lack of understanding of the challenges growers are facing in our industry”.

It is highlighting these issues to retailers, including the “unrealistic expectation” growers can continue to lower their costs in the current environment as increased cost of production and extreme weather become new norm.

Food inflation

While food inflation has been increasing since the start of COVID-19, it has skyrocketed in 2022.

The repercussion of COVID-19 and the inaction to assist the agricultural workforce shortage has contributed to a 9 per cent inflation rate, surpassing the previous 10-year peak twofold. But this hasn’t translated to increased returns for growers.

AUSVEG is aware that with the rising costs of living, many consumers are reducing their fresh consumption, while others are turning towards the freezer for cheaper frozen vegetable options.

The demand for cheaper vegetables may increase the risk of more imports, which may be further compounded by lack of supply in Australia due to ongoing inclement weather.

Additionally, growers are being forced out of business due to farm gate prices not covering the rising costs of production.

AUSVEG says vegetable producers have not been able to pass on the cost increases, unlike other food commodities.

In June 2022, the average retail price of vegetables was $5.55/kg, an 11.4 per cent increase from January 2020 prices.

With the labour shortage, exceptional weather events and increasing costs of production, the average retail price for vegetables in November 2022 has increased 20.5 per cent from January 2020 prices, well short of increases to most other commodities.

However, AUSVEG says the recent retail price increase does not cover the increases in costs experienced by growers.

AUSVEG understands that an increasing number of growers are making the difficult decision not to plant or harvest crops because the price growers are receiving from the retail chains doesn’t cover the costs of production due to increased input and labour costs.

In 2020 and 2021, the volume of vegetables produced remained relatively stable. In 2022 the overall volume has dropped despite increased prices.

Input prices

In some better news, some inputs are trending down from their peak.

While this is positive, they are still largely elevated from their pre-pandemic prices.

From January 2020 to November 2022, urea has increased 154 per cent, DAP 142 per cent and crude oil 56 per cent.

Major retailer prices and promos

The major supermarkets (Coles, Woolworth, Aldi, Metcash) are responsible for retailing 70 per cent of all vegetables produced.

This is a significant portion of the market, allowing the major supermarkets to have considerable control over the fresh produce industry.

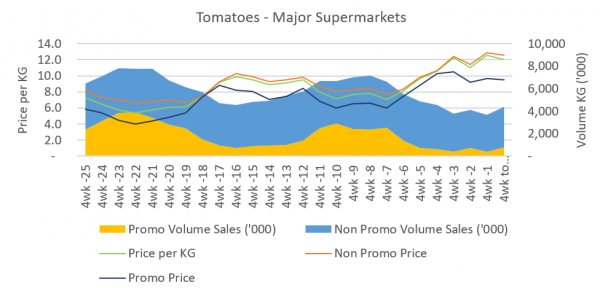

Promotions are traditionally used to clear stock when there is an oversupply in the market. They can be a useful tool to drive consumer demand and ensure food doesn’t go to waste.

At major retailers, 22 per cent of all vegetables are on promotion at any time. That equates to more than one in five vegetables on supermarket shelves always on special.

This creates a difficult trading environment where growers are always competing in a market where produce is sold for little or no margin.

With a supply chain dominated by a duopoly that buys 58.6 per cent of all vegetables produced, they have significant purchasing power over the supply chain and suppliers.

Farmland prices

Farmland prices are increasing across the country because of more demand from various buyers, increased ag commodity prices, favourable seasonal conditions, low interest rates and the supply of farmland available.

Demand is still exceeding supply, according to Rural Bank.

In its Australian Farmland Values 2021 Report the bank found the median price per hectare of Australian farmland increased by 20 per cent in 2021 to $7087 per hectare.

This was the largest year-on-year increase in dollar terms in the past 27 years and the largest rise in percentage terms since 2005.

The national median price has now increased for eight consecutive years, in which time it has risen by 123 per cent.

The increasing farmland costs drives higher land prices, pushing rates higher, and adding another cost increase to growers’ books.

ACCC update

The ACCC has introduced new and higher penalties for unfair contract terms (UTC).

This includes a fivefold increase in the maximum penalties and new penalties for businesses that include UTCs in their standard contracts.

Previously a court could determine standard contracts terms to be unfair and therefore void; however, until now they were unable to penalise businesses.

These changes apply only to businesses with fewer than 100 people and a turnover of less than $10 million. They will apply irrespective of the value of the contract.

ACCC chair Cass-Gottlieb said, “standard form contracts provide a cost-effective way for many businesses to contract with significant volumes of customers.”

However, by definition, these contracts are largely imposed on a “take it or leave it” basis.

The UTC laws are vital to protect consumers and small businesses against terms in these contracts that take advantage of this imbalance in bargaining power. AUSVEG are pleased these laws have been strengthened.

Businesses have 12 months to update their contract terms before these changes come into play.